Table of Content

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters.

A mortgage loan backed by the Department of Veterans Affairs, called a VA loan, is a mortgage option for current or former members of the armed services. This goes on until at the end of the loan, the principal repayments are almost 100% of the monthly annuity. In other words, your savings component increases, month by month, year by year. Under certain conditions, it is also possible to finance a property without equity. These include, for example, a very good credit rating, a very high income, and an excellent location of the property. To optimize the recommendation engine, we review daily the mortgage products and conditions of over 750 lenders.

Veterans United Home Loans overview

Keep in mind that you’ll need to pay a one-time VA funding fee based on the total loan amount, which can be rolled into your loan amount to avoid paying out of pocket at closing. Of course, the rates and fees that you’ll get will depend on your personal finances. So be sure to get rate quotes from 3-5 lenders before committing. Indeed, the company's loan team is specially trained to help military members and veterans and gets exceptionally high customer service ratings. You can check our rate table regularly for current information on various lenders.

You can also acquire a COE online via a lender’s portal on VA.org. Nevertheless, it’s simple to get a VA loan if you follow these six steps. You served for six creditable years or 90 days of active duty in the Selected Reserve or National Guard. You meet length-of-service requirements, generally 90 days in wartime and 181 days in peacetime. You will need a COE, which you can obtain from the VA website, or your lender can assist you with this. To get this certificate, you’ll have to produce service-related documentation, which can vary based on whether you are on active duty or a veteran.

Mortgage-related complaints at major lenders

In many cases, you’ll have the option to roll the VA funding fee into your loan. The typical funding fee ranges from 1.4% to 3.60% of the loan amount. After you have made your VA loan selection, you will need to provide your COE to show that you’re eligible to qualify for a VA loan. You can get it through your eBenefits portal or by requesting it through the mail. Next, you will work with a loan officer and complete an application, have your credit run, and get pre-qualified for the loan. You will need your social security number and identification and also may need proof of income such as a tax return.

According to a VA loan APR survey, the national average for a 30-year loan was 2.920% on Friday, November 26, 2021. According to Bankrate’s latest survey of the nation’s largest mortgage lenders, the average 30-year VA refinance APR is 2.980%. USAA offers personalized service during the jumbo loan process, and you can finance the VA funding fee. Veterans United won best overall for VA loan rates because it specializes in VA loans, veterans are their primary clients, and they have many loan program options.

How Often Do Rates Change?

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan. You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

We'll calculate your maximum property budget based on your income, savings, residency status and the criteria of our 750+ partner banks. This annuity payment consists of both interest and principal repayment. The composition of interest and repayment changes slightly with each month. This is because each repayment reduces the remaining loan balance. Combining this lender know-how with given information and projected information , we evaluate a range of scenarios and outcomes to see how you will fare under different conditions. We discuss the outcomes and logic of the recommendations with you.

Veterans United Home Loans rate transparency

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Assess your needs to determine if you currently require and qualify for a VA loan. The best VA loan rates are competitive and come from reputable mortgage lenders who specialize in VA loans and know the ins and outs of the programs including the borrower qualifications. They offer streamlined application processes and available agents to answer any questions along the way. Borrowers choosing VA loans make up the vast majority of Veterans United’s customers. Along with purchase loans, the lender offers two refinance options for VA borrowers. The first is the VA Interest Rate Reduction Refinance Loan, or IRRRL, which allows borrowers to take advantage of rate drops.

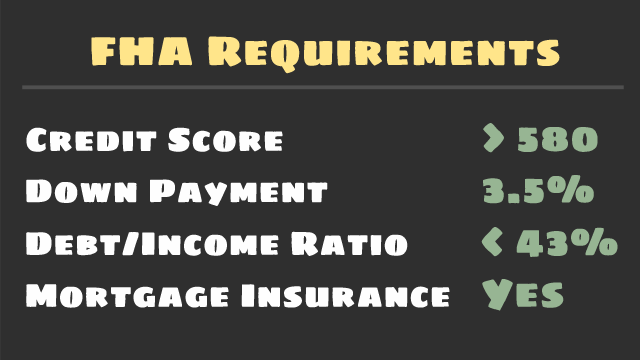

Some buyers finance their new home’s closing costs into the loan, which adds to the debt and increases monthly payments. Closing costs generally run between 2% and 5% and the sale prices. FHA and conventional mortgage rates tend to be higher than VA loan rates.

The Department of Veterans Affairs does not set mortgage rates. Your lender will determine the rate on your VA loan based on market rates, your credit profile and your financial situation. You may qualify for a lower interest rate if you choose to make a down payment.